File Past Due Tax Returns with Our San Antonio Experts

Planning for taxes

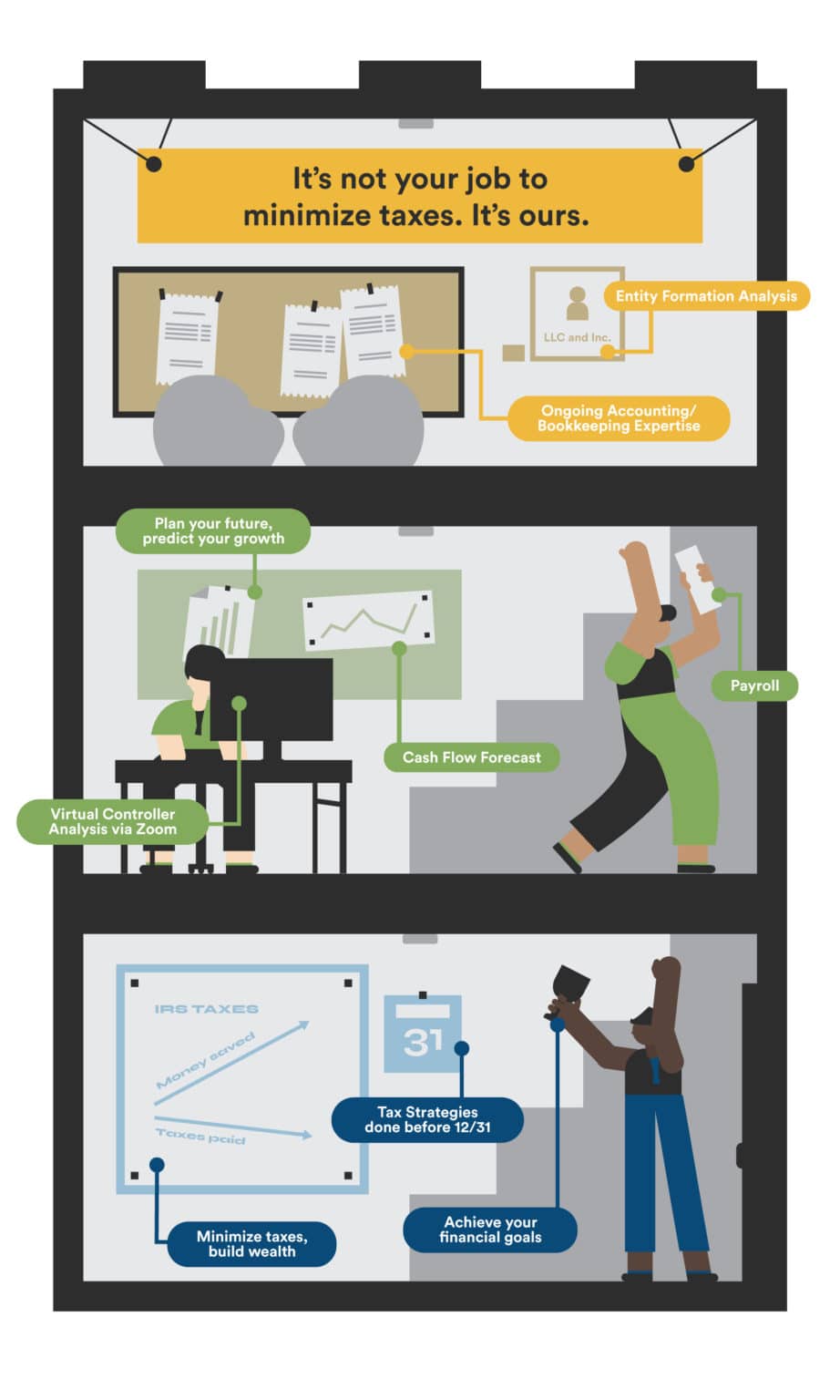

Contact us for tax preparation in San Antonio. Insogna CPA Tax Preparation in San Antonio . Tax planning can be confusing, especially when you don't know where to begin. Continue reading to find out more about S-Corps, and how we can lower your tax bill. We will also prepare your return to ensure that it is accurate and complete.

Tax preparation is an increasing career and provides a much-needed service to the local community. The IRS Free File Program offers two free ways to prepare and submit federal income taxes online. You should choose an accountant you can trust and with whom you have a good relationship.

Guaranteed. They can also resolve any issues that may arise. A CPA can help you to understand the latest tax changes and answer any questions you might have.

What tools can you use to increase your productivity? What does a tax professional do every day? San Antonio CPA firms are committed to offering personalized, professional services to both individuals and businesses, including in the areas of tax preparation and financial planning.