Tax Relief for Cannabis Businesses in San Antonio, Texas

Offshore investments

Finding someone who you can trust is important, whether your taxes are complex or straightforward. C-Corps are taxed as corporations.

Tax Relief for Cannabis Businesses in San Antonio, Texas - Sole proprietor tax minimization

- payment

- Sole proprietor tax minimization

- rate

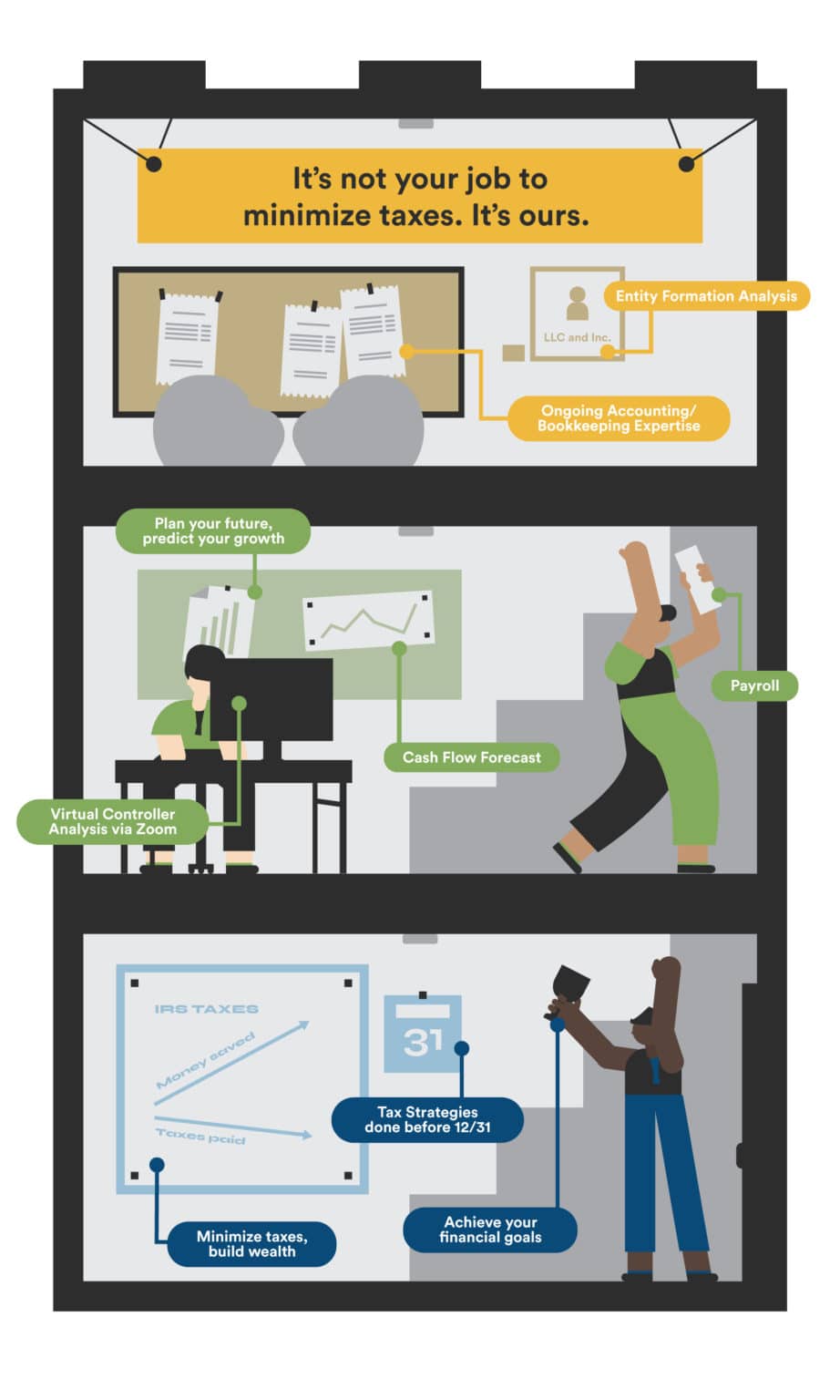

Stay on top of the latest laws and protect yourself from being audited: Corporate Transparency act and reasonable compensationInsogna is the best choice for all of your S-Corporation Tax Preparation needs. You have many things to consider as a business person when it comes time to pay taxes. Tax professionals can help you increase your bottom line by finding all available credits and deductions relevant to your industry.

Every year, our professionals help millions of owners of small businesses with their taxes. There are different types of S-Corporations, and their filing requirements may vary depending on the unique setup. Let us take care of the paperwork and you can save money on taxes.

You can choose from a variety of tax preparation options. These companies also have to comply with the IRS eFile regulations and Federal Trade Commission Privacy and Safeguards Rules. They can defend taxpayers before the IRS.