Medical Expense Deductions - San Antonio Tax Experts

Tax amnesty programs

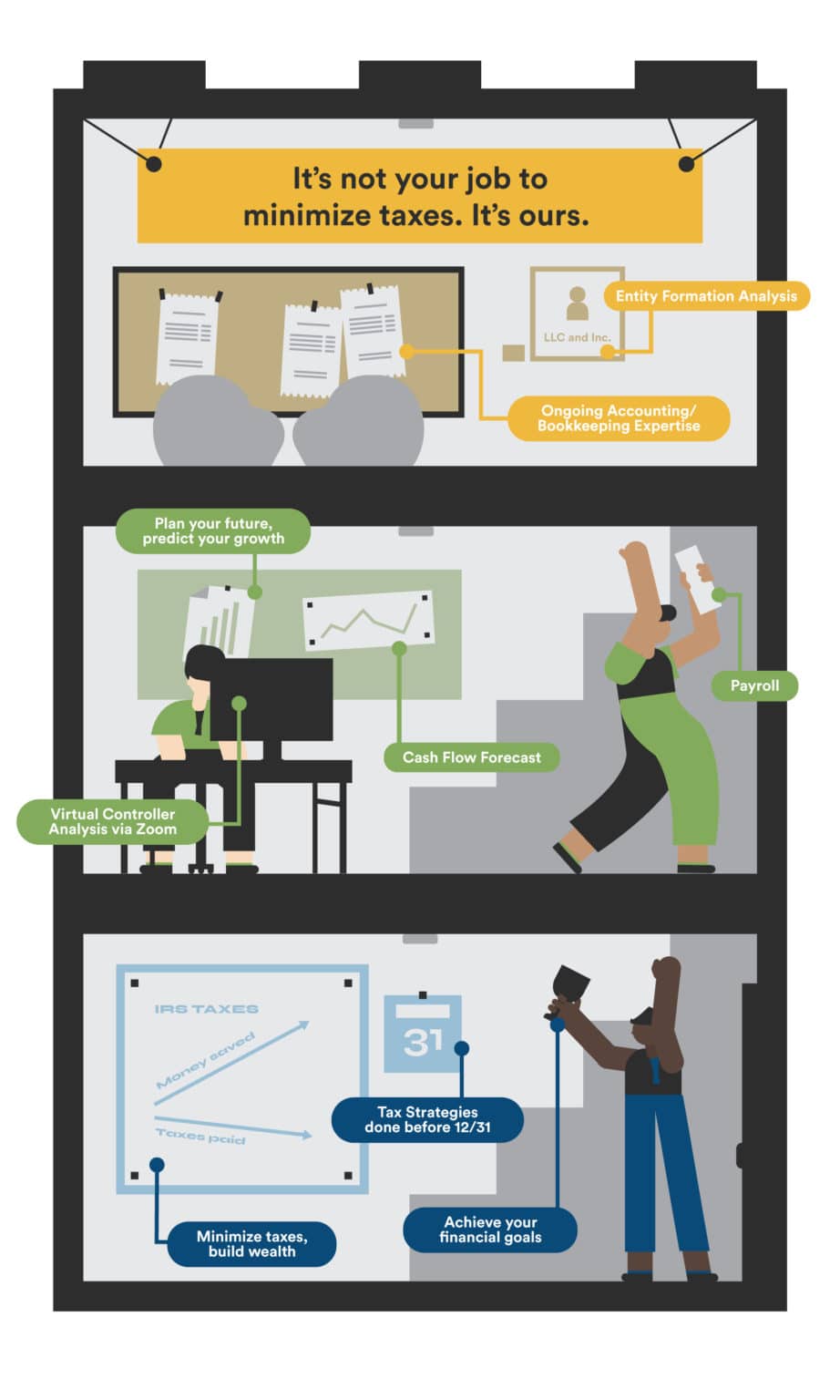

The extent of what tax preparers can do depends on their credentials, and whether or not they have representation rights. Consider having someone else do your taxes to save you time and reduce stress. You can rest assured that you'll receive exceptional, timely and accurate tax services, as well as sound advice, when you work with a CPA.

Medical Expense Deductions - San Antonio Tax Experts - Cryptocurrency taxes

- Eliminate tax debt

- Cryptocurrency taxes

- Innocent spouse relief

You can save up to 50% on a full-service accountant's rate by letting us handle your bookkeeping. *Go to disclaimer for more detailsWe can provide you with the best level of payroll assistance to ensure that you are compliant, pay your employees on time and manage payroll taxes. S-Corps are a special type of corporation which offers many advantages to small businesses. This tax is levied on certain entities that do business in Texas. Insogna CPA Tax Preparation for Small Business Near Me in San Antonio, TX .

Every year, our professionals help millions of small business owners with their taxes. If your business earns $100,000, the IRS will deduct corporate taxes from that amount before it is distributed to shareholders. We can give you more time to run your business with our professional bookkeeping service.

CPAs are experts who can help individuals and companies maintain financial records, prepare and file federal and state taxes, and ensure accuracy. We can help maximize your tax return, prepare you for tax season, and understand what to expect. Tax preparers must help their clients comply with state and federal tax laws while minimizing their tax burden.